Table of Contents

ToggleIntroduction

In the dynamic world of startup ventures, the quest for Early-Stage Startup Funding in 2024 is more crucial than ever. This funding is not just capital; it’s the catalyst that propels seed-stage startups from mere concepts to market disruptors. As we navigate the complexities of startup funding rounds, from seed to Series A, understanding the nuances becomes vital for success.

In this guide, we’ll unravel the intricacies of early-stage venture capital, offering a clear view of the funding landscape as it stands in 2024. We’ll dissect funding rounds explained in detail, providing you with the insights needed to secure that essential capital. Whether you’re a budding entrepreneur or an investor looking to tap into the next big thing, this article is your roadmap to mastering the art of early-stage funding.

Imagine a world where innovative ideas are seamlessly transformed into thriving businesses, thanks to well-strategized funding. That’s the power of informed decision-making in the realm of Series A-funded startups and beyond. So, let’s dive in and explore how these insights can guide your startup journey in 2024, setting the stage for success in an ever-competitive ecosystem.

The Landscape of Early Stage Funding

Introduction to the Section

As we approach 2024, the landscape of early-stage startup funding is on the cusp of significant evolution, marked by emerging trends and shifts. For entrepreneurs gearing up to seek seed stage startup funding and investors scouting for future opportunities, understanding these impending dynamics is crucial. This section will explore the anticipated changes and developments in the world of early-stage venture capital, providing a roadmap for those preparing to navigate these waters.

Current Trends in Early Stage Funding

The early-stage funding environment in 2024 is characterized by several key trends:

Increased Diversification of Funding Sources: Moving beyond traditional venture capital, alternative sources like crowdfunding platforms, corporate venture capital, and government grants are gaining prominence.

Rise of Impact Investing: There’s an escalating emphasis on impact investing, focusing not just on financial returns but also on positive social and environmental outcomes.

Preference for Sustainable and Scalable Business Models: Investors are showing a growing preference for startups that offer sustainable and scalable solutions, particularly in sectors like clean technology and healthcare.

Growing Importance of Data in Investment Decisions: The use of data in making investment decisions is becoming increasingly pivotal, with investors employing advanced analytics to evaluate the potential of startups.

Projections for 2024

Looking ahead, several projections for 2024 stand out:

Increased Investment in AI and Machine Learning Startups: The AI sector is anticipated to continue attracting significant funding, driven by its ongoing advancements and diverse applications.

Shift Towards Remote and Digital Solutions: In the post-pandemic era, there’s a heightened focus on startups offering remote working solutions, digital health services, and e-commerce platforms.

Emergence of New Tech Hubs: Beyond traditional centers like Silicon Valley, new tech hubs are emerging globally, diversifying the geographical landscape of startup funding.

For a more comprehensive view of the 2024 early-stage startup funding landscape, including detailed sector analysis and funding source breakdowns, visit our full infographic: “In-Depth Analysis: 2024 Early-Stage Startup Funding Landscape in the U.S.”.

Conclusion

As we look towards 2024, the landscape of early-stage startup funding is poised to become increasingly dynamic and diverse, signaling a shift towards technology-driven, sustainable business models. For startups preparing to seek funding and investors looking to capitalize on emerging opportunities, staying ahead of these trends will be essential. Understanding the evolving dynamics of early-stage venture capital and the intricacies of startup funding rounds will be key to navigating this future landscape successfully.

Early-Stage Funding by Sector - Projections for 2024

Introdution

As we anticipate the developments of 2024, it becomes crucial to project the trends in startup funding across diverse sectors. This section delves into the expected dynamics within technology, healthcare, and green energy sectors, drawing from current trends and future projections.

Tech Sector: Projected Front-Runner in Attracting Funding

Overview: The tech sector, particularly in AI, fintech, and cybersecurity, is expected to continue attracting substantial funding, driven by its potential for innovation and scalability.

Trends: A shift towards AI-driven solutions and blockchain technology is projected. Startups focusing on digital security and financial technology solutions are likely to be particularly attractive to investors.

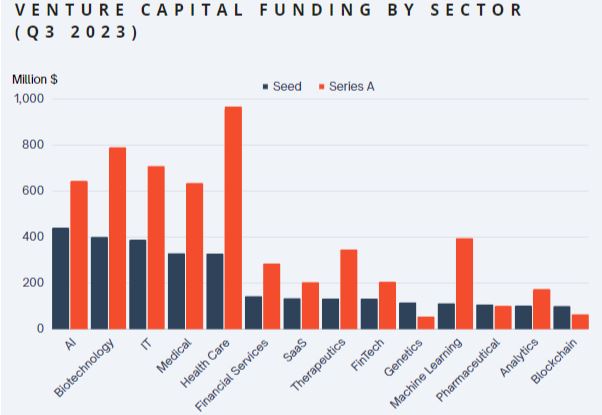

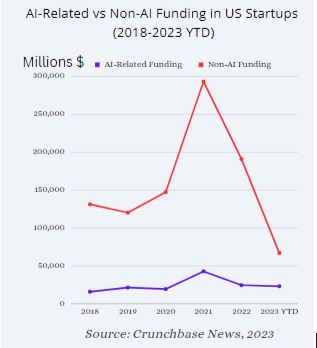

Graph Insight:

“AI-Related vs Non-AI Funding in US Startups (2018-2023 YTD)” – This graph demonstrates the growing investment in AI-related startups, emphasizing the tech sector’s focus on AI innovations, a trend expected to continue into 2024.

Healthcare Sector: Anticipated Focus on Innovation and Impact

Overview: Healthcare startups, especially in biotechnology and digital health, are projected to see a surge in funding, driven by the global emphasis on health and wellness.

Trends: Telemedicine, personalized medicine, and health tech startups leveraging AI and machine learning for diagnostics are expected to trend in attracting investments.

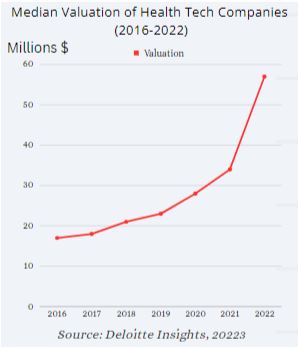

Graph Insight:

“Median Valuation of Health Tech Companies (2016-2022)” – This graph shows the steady increase in health tech company valuations, highlighting the growing investor interest in this sector, a trend likely to persist into 2024.

Green Energy Sector: Projected Sustainable Solutions Gaining Ground

Overview: With a global push towards sustainability, green energy startups are expected to increasingly become a focal point for investors.

Trends: Renewable energy, sustainable transportation, and energy efficiency technologies are key areas within this sector. A growing interest in startups that combine green technology with AI for optimized solutions is anticipated.

Graph Insight:

“Number of Deals in Climate Tech Startups (2018 Q1 – 2023 Q3)” – This graph illustrates the increasing number of deals in climate tech startups, showcasing the rising interest in sustainable and green energy solutions, a trend expected to continue into 2024.

Conclusion

The projected landscape of early-stage startup funding in 2024 indicates a strong inclination towards sectors that embody innovation, impact, and sustainability. While the tech sector is expected to maintain its dominance, healthcare and green energy are also set to play significant roles, each propelled by global trends and evolving demands.

Regional Analysis of Early-Stage Funding - Projections for 2024

Introduction

As we anticipate the developments of 2024, the global startup ecosystem is becoming increasingly interconnected, yet distinct regional characteristics continue to significantly influence early-stage funding trends. This section will explore the projected nuances across key regions: North America, Europe, Asia, and emerging markets, focusing on how regional economic conditions and regulatory environments are expected to impact startup funding.

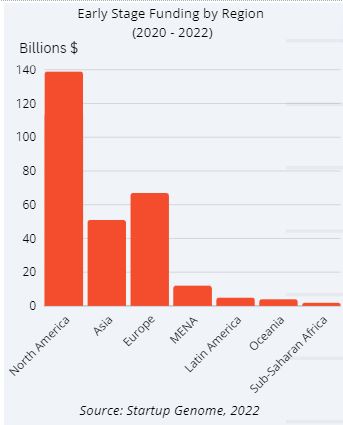

Graph Insight: “Early Stage Funding by Region (2020-2022)”

This graph offers a retrospective view of the funding landscape from 2020 to 2022, setting the stage for understanding the projected trends for 2024. It visually represents how different regions have contributed to the early-stage funding ecosystem, highlighting patterns and growth trajectories that are likely to influence future developments. This historical data provides a foundation for our projections, allowing us to anticipate changes and continuities in regional funding trends as we move towards 2024.

North America: Projected Continuously Evolving Ecosystem

Overview: North America, particularly the United States, is expected to remain a stronghold in startup funding, with Silicon Valley as a pivotal hub. The emergence of new tech hubs across the region is likely to diversify the landscape further.

Trends: A strong inclination towards tech and AI-driven startups is projected, supported by favorable regulatory frameworks in the U.S. and Canada.

Projection: In 2024, North America is anticipated to maintain a significant share of global early-stage funding, with a continued focus on AI and digital solutions.

Europe: Anticipated Balance of Tradition and Innovation

Overview: Europe’s startup scene is expected to continue blending traditional industries with emerging tech sectors, with cities like Berlin, London, and Paris as notable hubs.

Trends: An increasing focus on sustainable and green tech startups is projected, driven by the EU’s regulatory and funding initiatives.

Projection: European startups, particularly in the green tech sector, are likely to experience continued growth in funding, propelled by environmental policies and innovation.

Asia: Projected Rapid Growth and Diverse Opportunities

Overview: Asia’s startup ecosystem, especially in China and India, is expected to keep expanding rapidly, known for its diverse markets and large consumer base.

Trends: Fintech and e-commerce sectors are projected to remain strong, attracting significant investments.

Projection: In 2024, fintech startups in Asia are expected to continue their upward funding trend, reflecting the sector’s robust growth.

Emerging Markets: Projected Untapped Potential and Unique Challenges

Overview: Emerging markets, including regions in Africa, Latin America, and parts of Southeast Asia, are expected to show potential with their growing startup scenes.

Trends: Challenges like limited access to funding and regulatory hurdles are projected, but opportunities in mobile technology and financial inclusion are anticipated.

Projection: A notable growth in early-stage funding, particularly in mobile technology startups, is expected in African markets in 2024.

Conclusion

The projected landscape of early-stage startup funding in 2024 is anticipated to be as diverse as it is dynamic, with each region presenting its own set of opportunities and challenges. From the tech-driven markets of North America to the rapidly evolving ecosystems in Asia and the untapped potential in emerging markets, understanding these regional nuances will be crucial for global investors and entrepreneurs.

Founder Demographics and Funding

Introduction to the Section

As we approach 2024, understanding how founder demographics such as gender, ethnicity, and age might influence access to early-stage funding becomes increasingly important. This section explores the current state of founder demographics and their implications on funding opportunities in the startup world.

Impact of Founder Demographics on Funding Opportunities

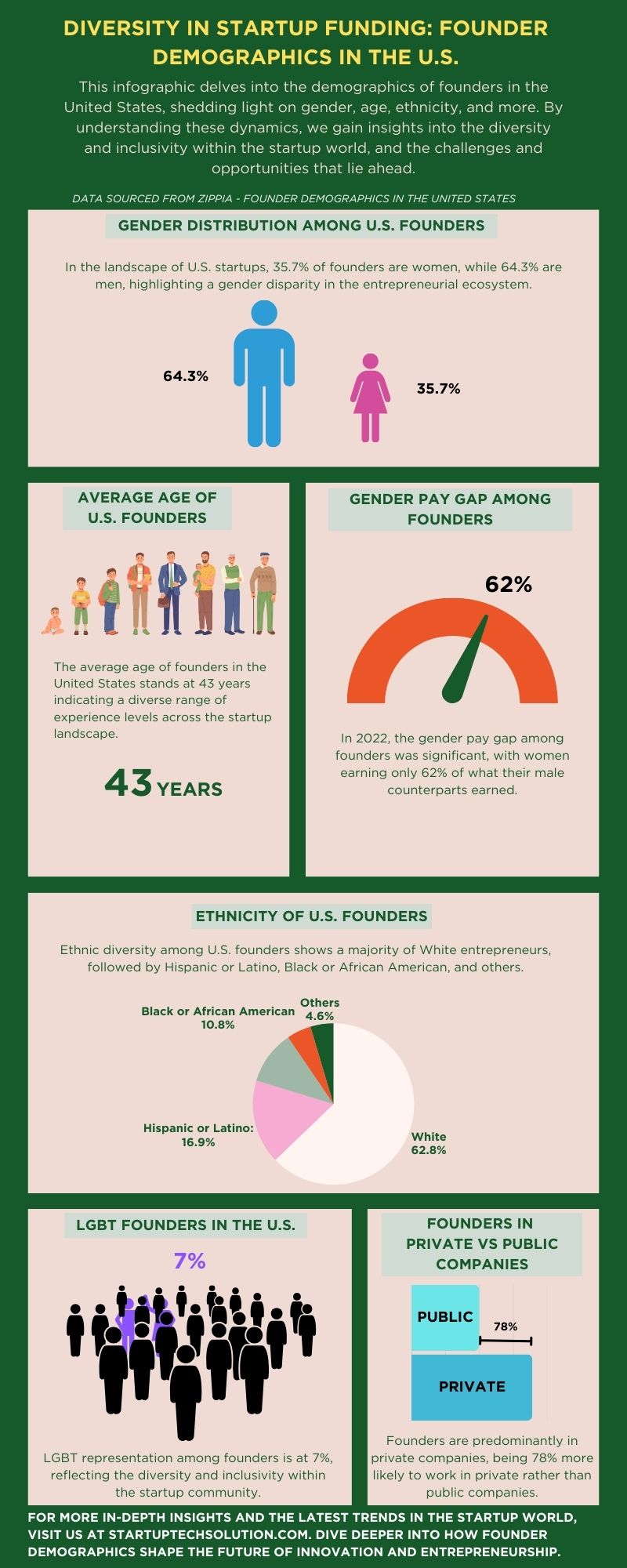

Overview: Founder demographics in the United States present a diverse yet uneven landscape. According to Zippia, there are over 26,430 founders currently employed in the U.S., with a significant gender disparity: 35.7% are women, while 64.3% are men. The average age of founders is 43 years old.

Trends: The most common ethnicity among founders is White (62.8%), followed by Hispanic or Latino (16.9%), Black or African American (10.8%), and Unknown (4.9%). In 2022, women founders earned 62% of what their male counterparts earned. Additionally, 7% of all founders identify as LGBT. Founders are 78% more likely to work at private companies compared to public companies.

Projected Trend: These demographics underscore the ongoing challenges and opportunities in achieving greater diversity and inclusion in early-stage startup funding. If current efforts towards inclusivity continue, we might witness a gradual shift in these statistics, with a more diverse range of founders gaining access to funding.

The State of Diversity and Inclusion in Startup Financing

Overview: The startup ecosystem is increasingly acknowledging the need for greater diversity and inclusion.

Challenges and Opportunities: Despite positive trends, significant gaps remain. Access to networks, unconscious bias, and systemic barriers continue to pose challenges for diverse founders. The ecosystem has the opportunity to evolve by rethinking traditional funding models and criteria and providing more support for underrepresented founders.

Visual Representation of Founder Demographics:

To better understand the current landscape of founder demographics in startup funding, the following infographic provides a visual representation of the data discussed. This visualization helps to illustrate the disparities and trends in a more accessible and engaging format.

Interpreting the Data:

The infographic above clearly shows the diversity in founder demographics and the disparities that exist in startup funding. It underscores the need for continued efforts in promoting inclusivity and diversity within the startup ecosystem. As we move forward, it’s crucial to monitor these trends and work towards a more equitable distribution of funding opportunities.

Conclusion

While there are positive strides towards inclusivity and diversity in startup financing, much work remains. Addressing these disparities is crucial for fostering a more equitable ecosystem and unlocking diverse perspectives essential for innovation.

Venture Capitalists’ Perspectives

Introduction to the Section

As we approach 2024, the strategies and perspectives of venture capitalists (VCs) continue to evolve. This section explores how VCs are evaluating early-stage startups and the differences in their strategies across various sectors and stages of development.

Evaluating Early-Stage Startups

Overview: Venture capitalists have a nuanced approach to evaluating early-stage startups. Key factors often include the strength of the founding team, the scalability of the business model, and the potential market size.

Trends: There is an increasing emphasis on startups that demonstrate a clear path to sustainability and profitability. VCs are also showing heightened interest in startups leveraging emerging technologies like AI and blockchain.

Differences in VC Strategies by Sector

Tech Sector: In the tech sector, VCs often look for startups with innovative solutions and the potential to disrupt existing markets. The focus is on scalability and the ability to quickly adapt to market changes.

Healthcare Sector: For healthcare startups, VCs typically prioritize strong scientific foundations and clear regulatory pathways. The potential for long-term impact on health outcomes is a significant consideration.

Green Energy Sector: In the green energy sector, VCs are interested in startups that can contribute to sustainability goals. The emphasis is on innovation in renewable energy sources and energy-efficient technologies.

Differences in VC Strategies by Stage

Seed Stage: At the seed stage, VCs are more focused on the founding team’s vision and potential market opportunity. The emphasis is on the idea and early development rather than immediate profitability.

Growth Stage: For growth-stage startups, VCs look for proven business models, growing revenue streams, and the potential for scaling up operations.

Projections for 2024

Looking ahead to 2024, VCs are expected to continue diversifying their portfolios, with a growing interest in sectors that align with global trends such as digital transformation, healthcare innovation, and sustainability. The approach to evaluating startups is likely to become even more data-driven, with a strong emphasis on long-term viability and market impact.

Conclusion

As the startup landscape evolves, so do the strategies of venture capitalists. Understanding these perspectives is crucial for startups seeking funding in 2024. The focus on sustainability, innovation, and market potential is set to shape the future of early-stage investments.

Types of Early-Stage Investors

Introduction to the Section

Exploring the variety of early-stage investors is crucial as we look towards 2024. This section examines different investor types, including angel investors, venture capitalists, and others, and their impact on startup funding.

Venture Capitalists and Corporate Venture Capital

Overview: Venture capitalists (VCs) and Corporate Venture Capital (CVC) are significant players in startup funding. They provide not only capital but also strategic guidance and networking opportunities.

Trends: VCs and CVCs are increasingly investing in high-growth sectors like technology and healthcare, with a focus on innovative and scalable business models.

Angel Investors

Overview: Angel investors are individual investors who offer early-stage funding, often in exchange for equity. They are known for supporting startups at their nascent stages.

Trends: There’s a growing trend of angel investors forming syndicates to pool resources and diversify risks.

Crowdfunding

Overview: Crowdfunding is a method where startups raise small amounts of money from a large number of people, typically via online platforms. It’s becoming a popular alternative for startups to secure funding.

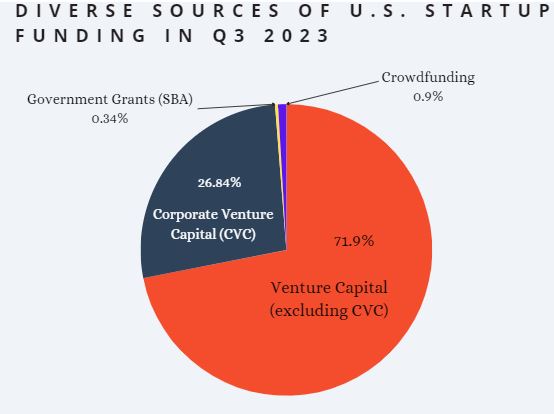

Graph Insight: “Diverse Sources of U.S. Startup Funding in Q3 2023”

This infographic provides a visual representation of the various sources of startup funding in the U.S. The graph highlights the diversity in investment types and underscores the dominance of venture funding in the startup ecosystem.

Source: Data sourced from EY’s Q3 2023 Venture Capital Investment Trends, CB Insights’ Corporate Venture Capital Trends Q3 2023, USA Spending’s Small Business Administration data for 2023, and Statista’s Crowdfunding projections for 2023.

Conclusion

The landscape of early-stage investors is diverse, with each type playing a unique role in the startup ecosystem. Understanding these different sources and their trends is essential for startups seeking funding and for investors looking to diversify their portfolios in early-stage startup funding.

Key Factors for Investor Attraction

In the dynamic world of startup funding, certain factors significantly influence a startup’s ability to attract investors. This section explores these critical factors, supported by real-life examples and expert insights, with a particular focus on Early-Stage Startup Funding in 2024.

Market Potential and Scalability

In the realm of early-stage investing, market potential, and scalability are often highlighted as critical factors. Renowned venture capitalist and author, John Doerr, in his book ‘Measure What Matters’, emphasizes the significance of scalability in startups. He notes that investors are particularly drawn to businesses that demonstrate not only a strong market presence but also the potential for exponential growth. This scalability factor is a key determinant in assessing the long-term viability and success of a startup. Doerr’s insights reflect a common sentiment among investors, underscoring the importance of a startup’s ability to grow rapidly and sustainably in a scalable market.

Source: John Doerr – Measure What Matters

Unique Value Proposition and Innovation

“Investors are often captivated by startups that offer a unique value proposition (UVP) – something that sets them apart in a crowded market. Innovation is the key here; a startup that brings something new or solves a problem in a novel way can quickly garner investor interest. For instance, the success story of ‘Impossible Foods’ is a testament to this. Their innovative approach to creating plant-based meat alternatives that closely mimic the taste and texture of real meat addressed a significant gap in the food industry. This not only set them apart from competitors but also aligned with growing consumer trends towards sustainable and ethical eating. Their UVP attracted substantial investment, highlighting how innovation and uniqueness can be powerful magnets for funding.”

Source: Impossible Foods Case Study

Strong Leadership and Team

“Investors often look for startups with strong leadership and a capable team. The success of a startup heavily depends on its team’s ability to navigate challenges and execute the business plan effectively. For instance, a Forbes article highlights the critical role of assembling the right leadership team in startups. It notes that 60% of ventures fail due to team-related problems, underscoring the importance of founders being aware of their strengths and weaknesses and hiring to complement these. This approach not only ensures operational efficiency but also signals to investors that the startup is well-managed and has a higher likelihood of success. A strong team, with a balance of skills and expertise, can significantly increase investor confidence in the startup’s potential.”

Source: Forbes – Founders, Leadership Teams And The Glue That Binds Successful Startups

Proof of Concept and Traction

For startups, one of the most persuasive ways to capture investor interest is by demonstrating a viable proof of concept (POC). This step is more than just a technical demonstration; it’s a crucial validation of the startup’s idea in the real market. A well-executed POC involves a clear definition of the problem being solved, an understanding of the target market, and a compelling presentation of the startup’s unique solution. Securing early funding can be a significant hurdle without tangible evidence of a startup’s potential. In some instances, startups have the opportunity to partner with larger corporations for POCs. These collaborations can be particularly beneficial, as they not only help validate the concept but also provide a stage to showcase the startup’s capacity to solve real-world problems. Such demonstrations of practical viability and early success are key to attracting investment and building confidence among potential backers.

Financial Health and Revenue Model

A startup’s financial health and its revenue model are critical factors that investors scrutinize before committing funds. A solid financial foundation and a clear path to profitability can significantly enhance a startup’s appeal to potential investors. Financial Health: Investors look for startups that manage their finances wisely. This includes having a reasonable burn rate, efficient use of resources, and a clear understanding of financial needs and projections. Startups that demonstrate financial prudence are often seen as lower-risk investments. Sustainable Revenue Model: A well-defined and sustainable revenue model is essential. Investors want to see how a startup plans to make money and sustain its business over the long term. This could be through direct sales, subscription models, service fees, or other revenue streams. Case Example: A startup like Stripe, which provides online payment processing for Internet businesses, is an excellent example of a company with a clear and sustainable revenue model. Stripe’s success in attracting significant investment can be attributed to its robust revenue model, which is based on transaction fees from its payment services. Investor Perspective: From an investor’s point of view, a startup with a strong financial foundation and a clear revenue model is more likely to succeed and provide a return on investment. They are looking for startups that not only have great ideas but also have a practical plan for making those ideas profitable. In conclusion, the financial health and revenue model of a startup are crucial in attracting investment. Startups that can demonstrate financial stability and a clear, sustainable path to profitability are more likely to gain the confidence of investors and secure the necessary funding.

Alignment with Current Trends and Consumer Demand

Understanding and aligning with current market trends and consumer demands is crucial for startups seeking investment. Investors are keen on funding businesses that not only have a solid understanding of the present market landscape but are also positioned to capitalize on emerging trends. Overview: Startups that demonstrate an awareness of evolving consumer preferences and market trends are often seen as more adaptable and forward-thinking. This alignment can be a significant factor in attracting early-stage funding. Trends and Consumer Behavior: In recent years, there has been a noticeable shift towards sustainability, digital transformation, and personalized services. Startups that incorporate these elements into their business models are more likely to resonate with both consumers and investors. Real-Life Example: A notable example is the rise of plant-based food companies like Beyond Meat. They tapped into the growing consumer trend towards plant-based diets and sustainability. Their alignment with these consumer preferences and market trends played a key role in attracting investors, leading to a successful IPO in 2019. Investor Perspective: Investors are often on the lookout for startups that not only meet current demands but are also capable of anticipating and adapting to future trends. This foresight is seen as a marker of potential long-term success and scalability.

Source: Beyond Meat IPO

Social Impact and Sustainability

“In the evolving landscape of startup investment, social impact and sustainability have become critical factors. Investors, especially those focused on impact investing, are increasingly drawn to startups that not only promise financial returns but also contribute positively to society and the environment. Overview: The rise of impact investing reflects a broader shift in the investment world, where the success of a startup is also measured by its social and environmental impact. This trend is reshaping how startups approach their business models and strategies. Growing Investor Interest: Impact-focused investors are particularly interested in startups that address key social and environmental issues, such as climate change, healthcare, education, and social inequality. These startups often find a more receptive audience among investors who value sustainability and social responsibility. Real-Life Example: One example is the success of companies like Lemonade, an insurance tech company that differentiates itself with a strong focus on social impact. Lemonade’s business model includes giving underwriting profits to charities chosen by its customers, aligning profitability with social good. This approach has not only garnered customer loyalty but also attracted investors who value both innovation and social responsibility. Long-Term Viability: Startups that integrate social impact and sustainability into their core operations are often seen as more viable in the long term. Investors recognize that these companies are likely to resonate more with modern consumers and have the potential to lead in their respective industries.”

Source: Lemonade Insurance

Navigating Early-Stage Funding – Understanding Key Terms and Strategies

In the journey of early-stage funding, founders encounter various financial instruments and terms. Among these, convertible notes, SAFE (Simple Agreement for Future Equity) agreements, and other key funding terms are particularly crucial. Understanding these concepts is not just a matter of financial literacy; it’s about strategically positioning a startup for success and sustainable growth in the context of Early-Stage Startup Funding in 2024.

Importance of Key Funding Terms for Early-Stage Startups

Convertible Notes

Why They Matter: Convertible notes are a popular choice for early-stage startups primarily due to their simplicity and flexibility. They allow startups to raise funds without immediately setting a valuation – a task that can be challenging and subjective in the early stages of a company.

Advantages: These notes defer the valuation question to a later stage, usually at the next significant funding round, when a more accurate company valuation can be determined. This can be beneficial for founders, as it potentially leads to a higher valuation due to the progress and development of the business.

Risks and Considerations: While convertible notes are beneficial, they come with obligations. They are a form of debt, and the terms set for interest rates and conversion can significantly impact the company’s equity structure in the future. Founders need to carefully negotiate these terms to avoid excessive dilution of their ownership.

SAFE Agreements

Why They Matter: SAFE agreements have emerged as a founder-friendly alternative to convertible notes. They are particularly important for early-stage startups due to their simplicity and the absence of debt.

Advantages: Unlike convertible notes, SAFE agreements do not accrue interest, reducing the financial burden on the startup. They provide a straightforward way for investors to invest in a startup with the agreement converting into equity at a later valuation.

Risks and Considerations: While SAFEs are simpler and may seem more attractive, they still require careful consideration of terms like valuation caps and discount rates. These terms will dictate the future equity stake that investors will receive, which can have long-term implications for the founder’s control and ownership.

Key Funding Terms

Valuation Cap: This term sets the maximum valuation at which the SAFE converts into equity. It protects investors from excessive dilution if the startup’s valuation skyrockets in subsequent rounds.

Discount Rate: The discount rate determines the price at which the SAFE converts into equity compared to other investors in the same round. A higher discount rate benefits investors.

Equity Ownership: The percentage of a company’s ownership that an investor receives in exchange for their investment. It’s a crucial factor in determining control and decision-making power.

Burn Rate: The rate at which a startup uses up its cash to cover operating expenses. Founders must manage the burn rate effectively to ensure the company remains financially stable.

Runway: The amount of time a startup can continue operating with its current cash reserves and burn rate. A longer runway provides more time to secure additional funding.

Dilution: The reduction of a founder’s ownership stake in the company due to the issuance of new shares to investors. Dilution is a natural part of the funding process but must be managed carefully.

Broader Context for Early-Stage Funding Terms

Understanding these key funding terms and strategies is part of a broader necessity for startup founders to be well-versed in funding jargon and financial concepts. This knowledge empowers founders to make informed decisions, negotiate better terms, and ultimately guide their startups through the complex landscape of early-stage funding. It’s about striking the right balance between securing necessary capital and maintaining control and ownership of their venture.

By mastering these essential financial concepts, founders can approach funding rounds with confidence, ensuring that their startup not only secures the capital it needs but also retains the flexibility and control necessary for long-term success and growth in the evolving landscape of Early-Stage Startup Funding in 2024.

Paving the Path for Early-Stage Funding – Predicting the Future

As we venture beyond 2024, the landscape of early-stage funding for startups is poised to evolve in response to emerging trends and shifting investor sentiments. While the future always carries an element of unpredictability, we can make educated predictions based on the trajectory of recent developments.

1. Rise of Non-Traditional Investors

One notable shift is the increasing presence of non-traditional investors in early-stage funding. While venture capitalists and angel investors have long been the primary sources of funding, new players are entering the arena. Crowdfunding platforms, family offices, and even corporations are showing interest in backing promising startups. This diversification of funding sources can offer founders more options but may also come with different expectations and terms.

2. Continued Emphasis on Diversity and Inclusion

The call for greater diversity and inclusion in the startup ecosystem is unlikely to wane. As the importance of diverse perspectives becomes more apparent, we can expect to see a continued focus on supporting underrepresented founders. Impact-focused investors and initiatives promoting diversity will play an essential role in reshaping the funding landscape.

3. Tech Evolution and Emerging Sectors

Technology will remain a driving force behind early-stage funding. However, the specific sectors within tech that attract the most investment may shift. Emerging technologies like quantum computing, biotech innovations, and space exploration are gaining traction. Startups positioned at the intersection of these technologies will likely capture investor attention.

4. Globalization and Cross-Border Funding

The world is more interconnected than ever, and startups can now access funding from international sources more easily. Cross-border funding rounds and global investment syndicates will become more common. This trend will provide startups with access to a broader pool of capital but may also introduce complexities related to regulatory compliance and market nuances.

5. Environmental and Social Responsibility

The importance of environmental and social responsibility in business is only expected to grow. Startups addressing critical issues, such as climate change, healthcare access, and education, will find themselves in a favorable position to attract impact-driven investors. Additionally, businesses that adopt sustainable practices in their operations will be better positioned for long-term success.

6. Technological Advances in Due Diligence

Advances in technology, including artificial intelligence and data analytics, will transform the due diligence process. Investors will have access to more comprehensive data, allowing for better-informed investment decisions. Startups with a robust data-driven approach to their operations will have a competitive advantage.

7. Regulatory Changes

Government policies and regulations around startup funding will continue to evolve. New regulations may aim to strike a balance between investor protection and fostering innovation. Staying informed about these changes and adapting to them will be crucial for startups and investors alike.

8. Resilience in Times of Uncertainty

The ability to navigate uncertainty and adapt to unforeseen challenges will remain a fundamental trait of successful startups. Events like economic downturns, global health crises, and geopolitical shifts can impact funding availability. Founders who build resilient and flexible business models will be better prepared to weather such storms.

In conclusion, the future of early-stage funding is shaped by a dynamic interplay of factors, from shifting investor preferences to technological advancements and global trends. While the landscape may evolve, the core principles of innovation, tenacity, and effective communication between founders and investors will continue to underpin successful fundraising efforts. As the journey beyond 2024 unfolds, founders and investors alike must remain agile and open to embracing new opportunities in the ever-changing world of startup funding.

Conclusion

The early-stage funding landscape in 2024 is a dynamic and evolving space, with each sector revealing unique trends and opportunities. As we’ve explored in this article, understanding these trends is crucial for entrepreneurs and investors alike, guiding their strategies in this ever-changing environment.

To gain a more comprehensive view of the 2024 early-stage startup funding landscape, including detailed analyses and sector-specific insights, we invite you to explore our full infographic: “In-Depth Analysis: 2024 Early-Stage Startup Funding Landscape in the U.S.” While it’s not yet 2024, this resource provides a glimpse into the funding dynamics that are poised to shape the future of startups across various industries.

In the world of startups, staying informed and adaptable is key. Whether you’re launching your own venture or seeking investment opportunities, these insights will serve as your compass, helping you navigate the intricate terrain of early-stage funding and innovation.

![You are currently viewing Everything You Need to Know About Early-Stage Startup Funding in 2024: Unveiling Trends, Strategies, and Insider Insights [A Comprehensive Guide]](https://startuptechsolution.com/wp-content/uploads/2023/11/Everything-You-Need-to-Know-About-Early-Stage-Startup-Funding-in-2024-Unveiling-Trends-Strategies-and-Insider-Insights-A-Comprehensive-Guide.jpg)